Self Employment Grant Contact Number

You will need the Government Gateway user ID and password that was used when the claim was made along with the grant claim reference found on the copy of the grant claim acknowledgement and the Self-Assessment Unique Taxpayer Reference UTR number. A recent payslip or P60 or a valid UK passport.

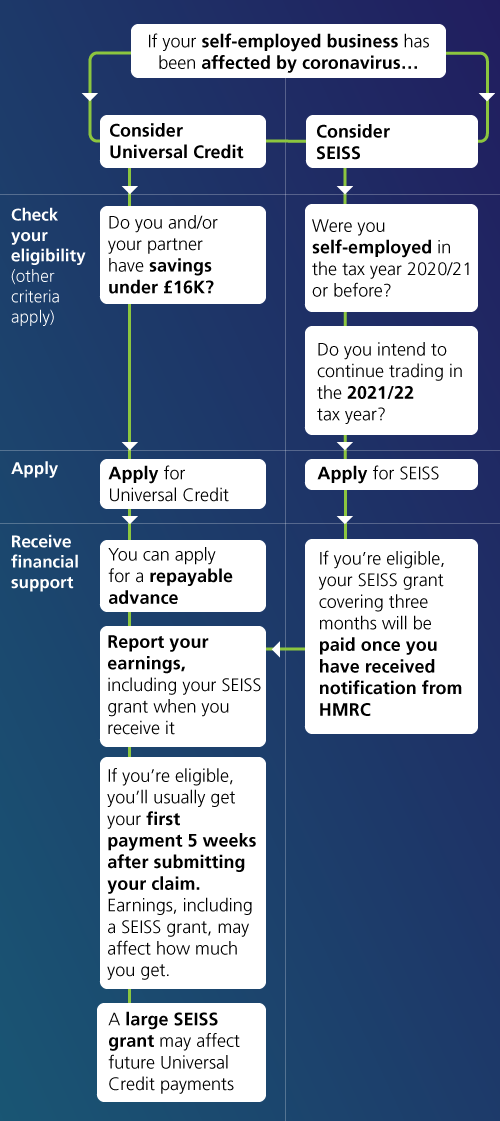

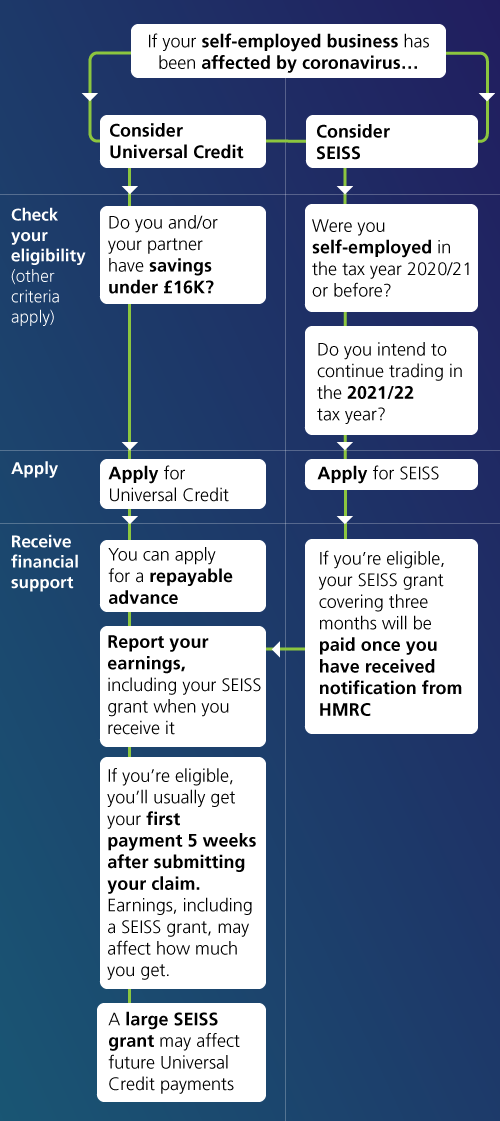

Self Employment Understanding Universal Credit

How to check if you are eligible for the Self-employment Income Support Scheme.

Self employment grant contact number. If you were eligible for the first grant and can confirm to HMRC that your business has been adversely affected on or after 14 July 2020 youll be able to make a claim for a second and final grant from 17 August. If you cannot use our online services. We will contact you if you have already booked an appointment with us.

Contacting 08 and 03 numbers. It is possible to contact HMRC by webchat or by telephone. Alternatively the phone number to speak to HMRC about SEISS is 0800 024 1222.

You can still contact us and get help. If youre not able to use our online services you can contact us for help. The digital assistant may also be able to help people find out whether they may be eligible for the fifth grant.

To avoid this cancel. Grantsgov Applicant Support is available 247 except federal holidaysBe sure to include supporting details when you call or email. HMRC will contact eligible workers from mid-July to let you know when you can make your claim.

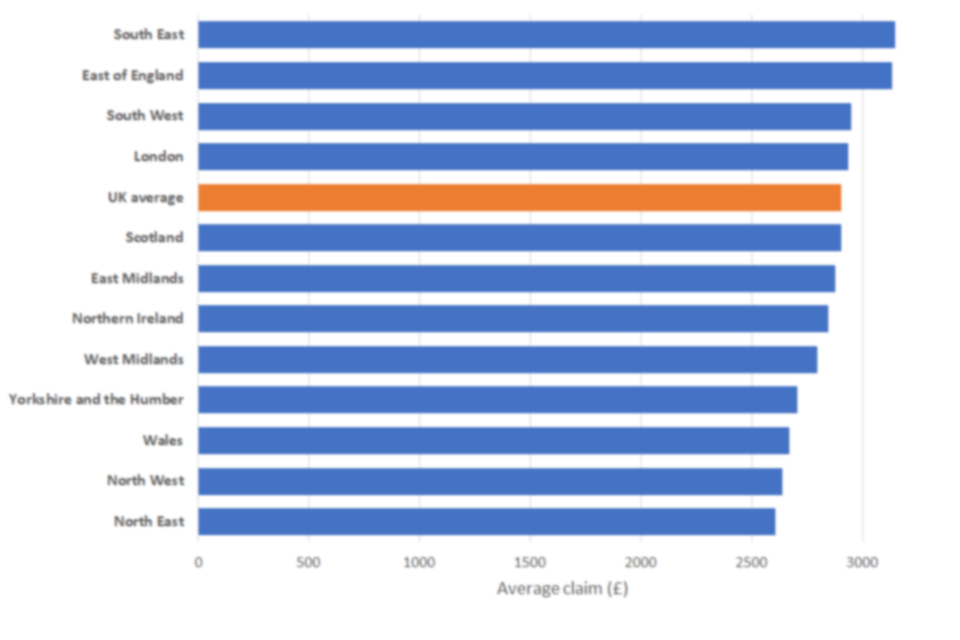

You can still contact us and get help. As of January 31 2021 there had been approximately 219 million claims made to the United Kingdoms third self-employment support scheme a scheme launched to protect the incomes of the self-employed during the Coronavirus pandemic following the conclusion of the first and second schemes in 2020. We will only contact you if there is a problem with your payment.

44 135 535. SEISS claimants can call between 8am and 4pm Monday to Friday. Your National Insurance number.

How to contact HMRC about self-employed grants. This page has been updated with the information for the third grant of the Self Employed Income Support Scheme. Phone 0300 200 3500.

Self-employment Income Support Scheme SEISS. Contact details for HM Revenue Customs newly self-employed helpline. Grantors should contact their assigned Grantsgov Program Advisor for questions and support.

HMRCs digital assistant can provide more information about SEISS grant five. HMRC is contacting everyone it thinks may be eligible to make a claim based on information it already holds. Use webchat or phone to contact HMRC to help with the Self-Employment Income Support Scheme.

The contact details are contained on this webpage Contact HMRC for help with Self-Employment Grant Claims. The government has provided new details on the fifth self-employment grant. The Grantsgov support resources are here to help you successfully find and apply for grants.

If you realise that you have made a mistake when reporting your turnover in your claim and think you should have received the higher grant amount youll need to contact. If playback doesnt begin shortly try restarting your device. Website HM Revenue Customs newly self-employed helpline.

Welcome to Grantsgov Support. Other ways to contact us. It is also possible to contact HMRC via the phone on 0800 024 1222.

The Self-Employment Income Support Scheme Grant Extension provides critical support to the self-employed in the form of two grants each available for three month periods covering November 2020 to January 2021 and February 2021 to April 2021. Videos you watch may be added to the TVs watch history and influence TV recommendations. External link opens in a new window tab external link opens in a new window tab.

THE SELF-EMPLOYMENT Income Support Scheme SEISS has provided taxable grants to eligible claimants over the course of the UK lockdown. The deadline for the first grant in this scheme closed on 30 June. However not everyone who is contacted will be entitled to a grant.

It is also possible to speak to an adviser online about the scheme via webchat. Alternative ways of claiming the self-employment grant. 20 October 2020 The service is now closed for the Self-Employment Income Support Scheme.

Call HMRC if youre self-employed and have an Income Tax enquiry or need to report changes to your personal details. To create a Personal Tax account click here.

How To Claim 4th Self Employment Grant The Seiss Payment Explained And When The Hmrc Deadline To Apply Is

Coronavirus Seiss Fifth Grant Low Incomes Tax Reform Group

Coronavirus Help For The Self Employed Explained Which News

Your Self Employed Tax Return Youtube

Fifth Self Employed Income Support Scheme Grant To Open For Claims In July Taxassist Accountants

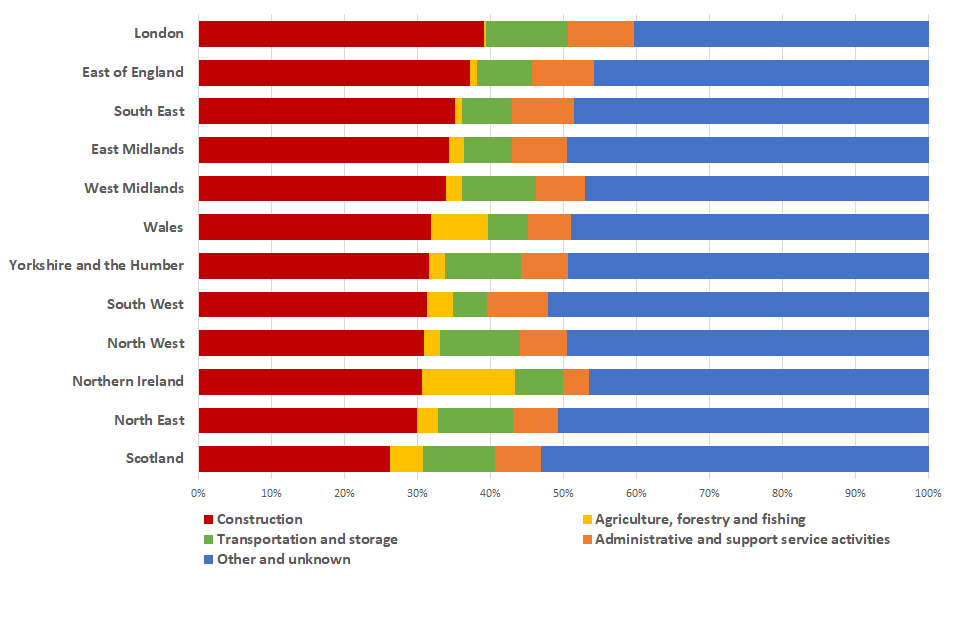

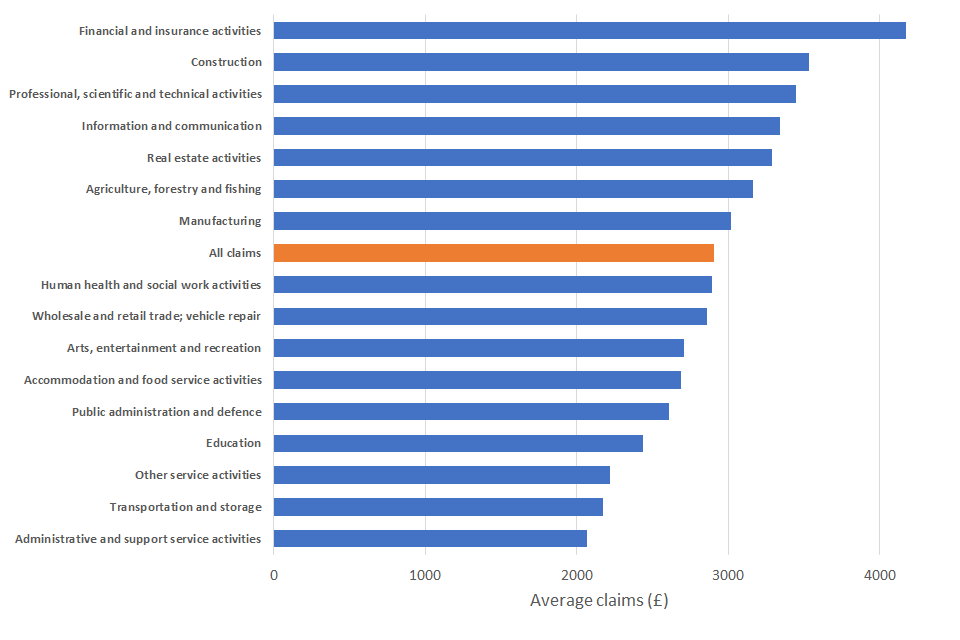

Self Employment Income Support Scheme Statistics July 2020 Gov Uk

Can I Claim A Self Employed Grant How Much Will I Get And When Will It End

Coronavirus Help For The Self Employed Explained Which News

Coronavirus Seiss Fourth Grant Low Incomes Tax Reform Group

Self Employment Income Support Scheme Supporting Your Clients With Their Claim For The Fifth Grant Youtube

Self Employment Income Support Scheme Statistics July 2020 Gov Uk

Self Employment Understanding Universal Credit

Seiss Grant 5 When Can I Claim 5th Hmrc Self Employed Grant Date Applications Open And Who Can Apply The Scotsman

Seiss Grant What Is Seiss And How Do I Apply

Seiss 5th Grant When And How Can I Claim It Mcl

Self Employment Income Support Scheme Statistics July 2020 Gov Uk

Post a Comment for "Self Employment Grant Contact Number"