Newly Self Employed Helpline Hmrc

To get an up to date estimate of how long your application will take you can call HMRC. So how can you contact HMRC about the SEISS grants.

Self Employed How To Claim The Latest Self Assessment Grant

Other ways to work for yourself.

Newly self employed helpline hmrc. Must register and sign in 5 minutes before it starts. HMRC will be writing to approximately 100000 self-employed asking them to complete some pre-verification checks. Call the HMRC Newly Self-Employed Helpline on 0300 200 3500 or register online at HMRC.

HMRCs guidance says the self-employment registration process takes 7 10 days to complete. If you receive the grant you can continue to work or take on other employment including voluntary work. Use webchat or phone to contact HMRC to help with the Self-Employment Income Support Scheme.

They will register you for Self Assessment tax. 20 October 2020 The service is now closed for the Self-Employment Income Support Scheme. If you register for a webinar you.

However there can be delays with this timescales. Phone 0300 200 3500. Can ask questions using.

Contact HMRC for advice if youre not sure whether youre trading. So if you are a locum Optometrist or locum Dispensing Optician and started locuming post April 2019 this could be you. How to contact HMRC about self-employed grants THE SELF-EMPLOYMENT Income Support Scheme SEISS has provided taxable grants to eligible claimants over the course of the UK lockdown.

In most cases you can register as self-employed by calling the Newly Self-employed Helpline on 0300 200 3504. If youre self-employed you may need to set up as a sole trader. 1524 Thu Jun 24 2021.

You can get this form. A one-off grant of 2000 is available for newly self-employed individuals who are ineligible for other Scottish Government or UK Government schemes. You must also complete a self-assessment tax return and pay any tax due to HMRC.

If youre self-employed and have a National Insurance enquiry or need to report changes to your personal details to register for National Insurance Income Tax and VAT if youve recently become. There should then be an option there. For further information you can contact HMRCs Coronavirus COVID-19 helpline.

All I can suggest is that you check your return has been received by going to the Tax Return Options section of your Self-Assessment online account and assuming this is the case and at least 72 hours have passed from your submission then any credit balance due back to you should be able to be seen in the Current Position section of the account. HMRC have announced that they will contact the newly self-employed who may be eligible to counteract any potential fraud. They are closed on bank holidays.

Website HM Revenue Customs newly self-employed helpline. Contact details for HM Revenue Customs newly self-employed helpline. Applicants may only make an application for grant support to one local authority and may not receive more than one payment under the scheme.

If you have one already call the Newly Self-Employed Helpline on Tel 0845 915 4515. Youll need to provide HMRC with your name. If you find that you are self employed for some of your jobs you must register as self-employed using the HMRC online services or by calling the HMRC Newly Self-Employed Helpline on 0300 200 3504.

Lines are open 800 am to 800 pm Monday to Friday and 800 am to 400 pm on Saturday. 1524 Thu Jun 24 2021 UPDATED. Important if you do not register within three months of your business starting you could face a 100 penalty.

If you have any enquiries about the Newly Self-Employed Support Scheme complete the online enquiry form or contact the helpline on Tel. When you contact HMRC to register as self-employed you need to ensure that you are also registered as a CIS subcontractor. Name and type of business and start date.

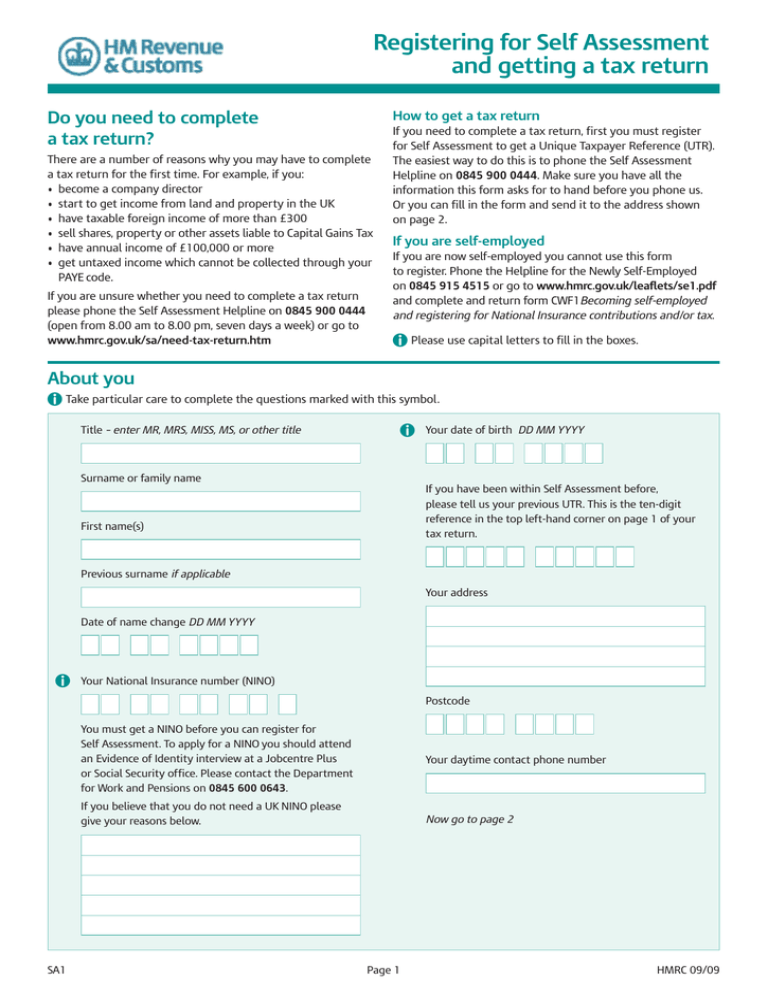

You can sign up for email alerts about help and support if you are self-employed. This is a simple process you can register over the telephone by calling the Newly Self-Employed Helpline on 0845 915 4515 or online by completing the online registration form alternatively if you prefer paper forms you can complete form CWF1 and post it to HM Revenue Customs. This page has been updated with the information for the third grant of the Self Employed Income Support Scheme.

Or you can fill in form CWF1 Becoming self-employed and registering for National Insurance contributions andor tax.

Set Up As Self Employed A Sole Trader Step By Step Gov Uk

How To Register As Self Employed With Hmrc Ridgefield Consulting

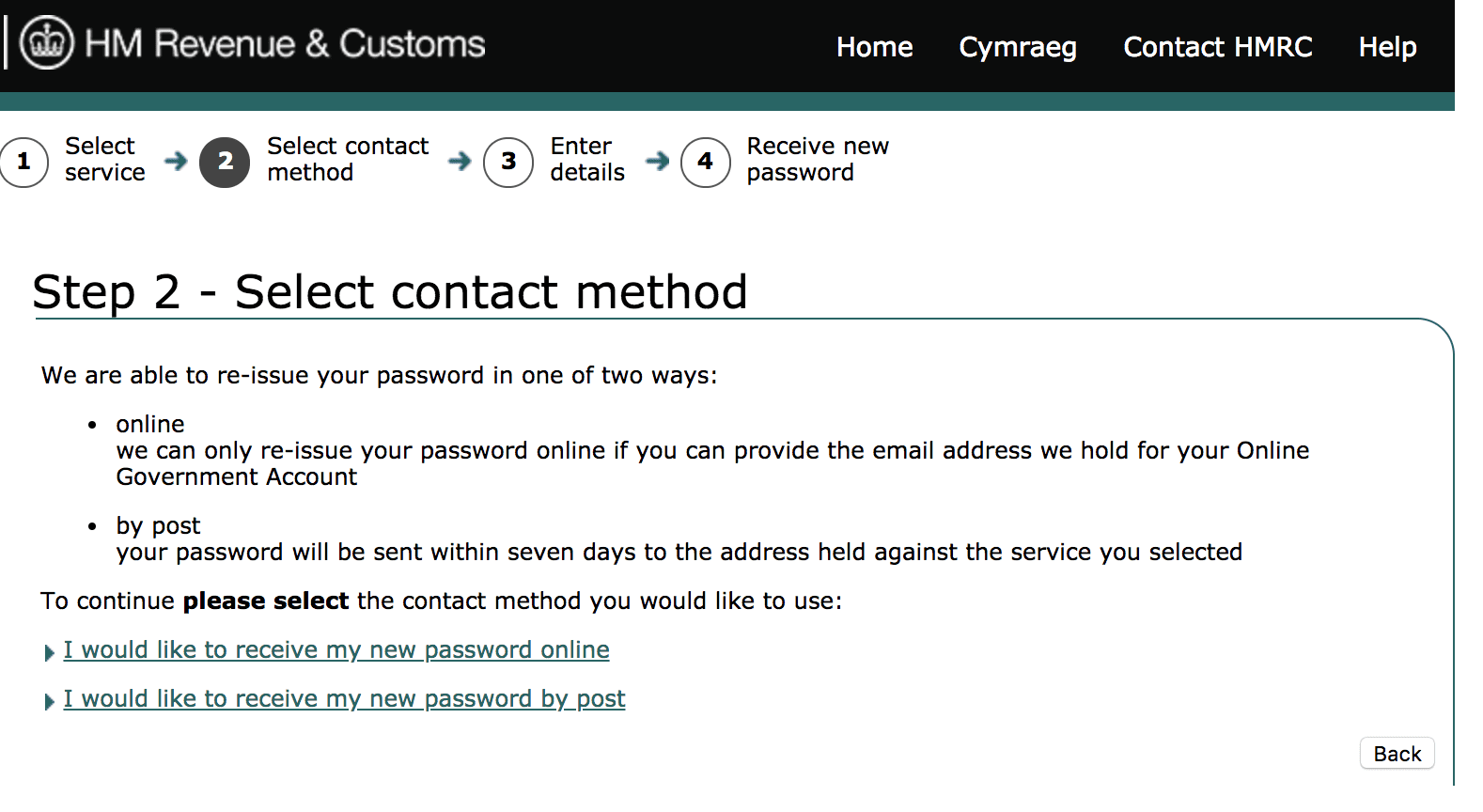

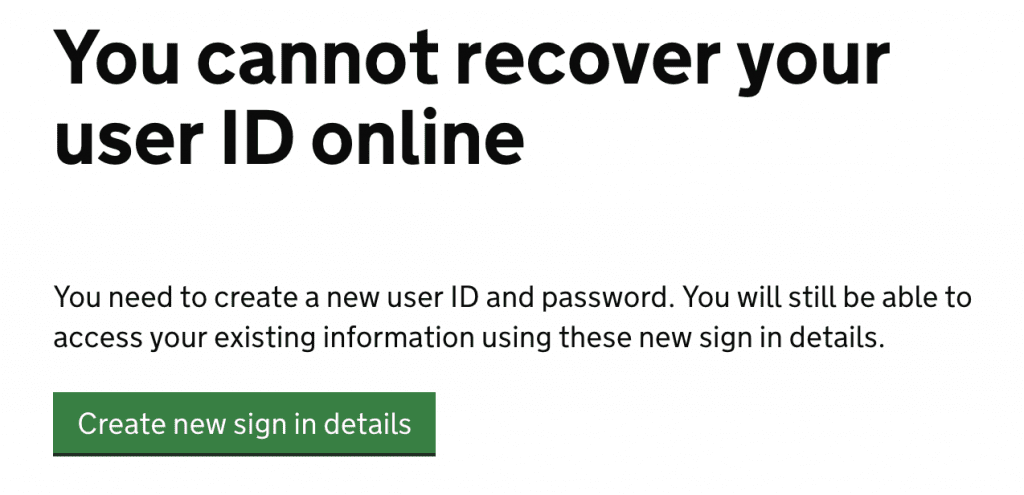

What To Do If You Have Lost Your Hmrc User Id Password

Income Tax Form Hmrc Why You Should Not Go To Income Tax Form Hmrc Tax Forms Income Tax Income

Set Up As Self Employed A Sole Trader Step By Step Gov Uk

Cryptocurrency Taxes In The Uk The 2021 Guide Koinly

Registering For Self Assessment And Getting A Tax Return

Income Tax Form Hmrc Why You Should Not Go To Income Tax Form Hmrc Tax Forms Income Tax Income

What To Do If You Have Lost Your Hmrc User Id Password

Uk Government We Re Supporting The Self Employed With Direct Cash Grants Those Eligible For The New Scheme Can Apply Directly To Hmrc For The Grant Which Will Be Paid Directly Into People S

I Am An Artist Do I Need To Register Myself To Hmrc

Coronavirus Latest Rishi Sunak To Give Hmrc Draconian Powers To Reclaim Hundreds Of Millions In Covid 19 Support Payments

What To Do If You Have Lost Your Hmrc User Id Password

A Warning Regarding Hmrc Phishing Attempts Mitchell Charlesworth

An Introduction To The Tax System For The Self Employed

How To Register As Self Employed In The Uk A Simple Guide

Self Assessment Payments On Account Explained

Fifth Seiss Self Employed Grant How To Apply And How Much You Ll Get Mirror Online

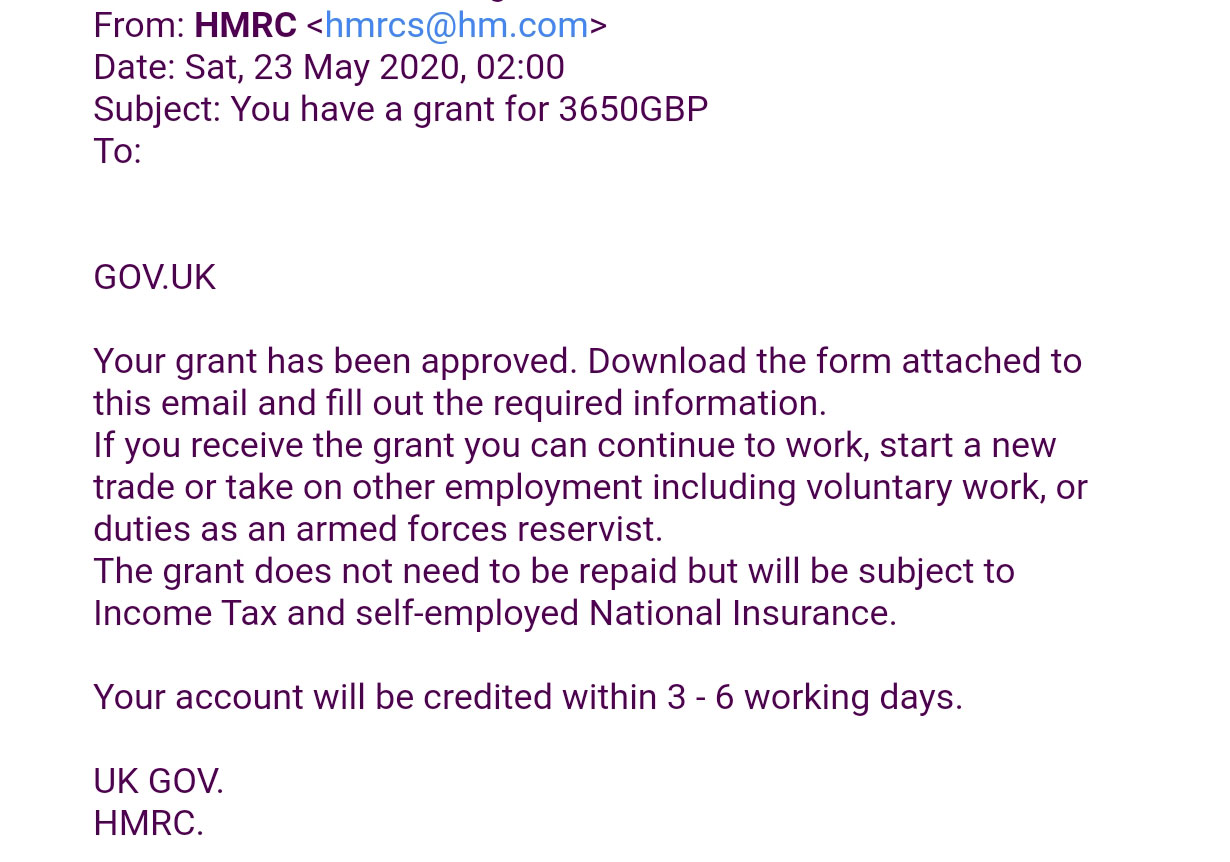

Hmrc Fake Grant Scam Tax Mail Claims Self Employment Grant Has Been Approved

Post a Comment for "Newly Self Employed Helpline Hmrc"