Can I Claim The Self Employment Grant

If you still think the grant amount is too low you or your agent can contact HMRC. Further HMRC Guidance for claiming the grant will be available by the end of June 2021.

Seiss 5th Grant When And How Can I Claim It Mcl

A spokesman for HMRC said that self-employed workers who had been adversely affected by the pandemic should claim for the second and final.

Can i claim the self employment grant. A fifth and final self-employed grant worth up to 7500 covering May to September will be open to claims from late July. This means more of those who are newly self-employed could be able to apply for the latest grants as before only people with tax returns covering the 2018-19 tax year could apply. Similarly the taxpayer must have been in business before 6 April 2020 and submitted a tax return including self-employed profits for 201920 by 2 March 2021 in order to qualify for the SEISS grant.

Stage one outlines requirements for the claimants trading. If youre eligible based on your tax returns HMRC will contact you in mid-July to give you the earliest date from when you can make your claim see how. The claims service will then tell you if you can claim the higher or lower grant.

HMRC has been contacting those who are eligible for the fifth self-employed grant since mid-July. Claimants who are eligible for SEISS can claim the third grant and still work. Claims can be made via the HRMC website.

You cannot claim the grant if you trade through a limited company or. Self-employed people should now be able to apply for a fifth and final Self-Employment Income Support Scheme SEISS grant. When you make your claim the online service will ask you for your turnover figures and compare them for you.

HMRC has set out three stages of criteria that claimants must meet to get the fifth grant. The online claims service for the fifth grant will. Who Can Claim the SEISS 5th Grant To be eligible for the SEISS 5th grant you must be a self-employed individual or a member of a partnership.

Youre allowed to keep working and. You cannot claim the grant if you trade through a limited company or a trust. It is possible that the taxpayer could have several successive or concurrent trades in which case the sales figures for all trades must be aggregated for the year to April 2021.

Forgot to apply for the 2nd self employed grant SEISS by deadline Hello The deadline to claim 2nd self employed grant SEISS was 19 OctoberThe client forgot to apply. Who can claim the fifth self-employed grant. Your National Insurance number.

You or your agent will need. The fifth self-employment grant covers lost or reduced earnings from May to September 2021 offering up to 80 of trading profits or 7500 over three months. Check if you can claim a grant through the Self-Employment Income Support Scheme How HMRC works out trading profits and non-trading income for the Self-Employment.

Can you claim self-employed grant and still work. Official guidance from HMRC says that to make a claim. Unfortunately though people will be unable to claim the grant if they.

Your grant claim reference. Self-employed people will be able to apply for a fifth and final Self-Employment Income Support Scheme SEISS grant later this month. To be eligible for the fourth grant you must be a self-employed individual or a member of a partnership.

You must be a self-employed individual or a member of a partnership. Individuals are required to be self-employed or a member of a partnership and have traded in both 201920 and 202021. HMRC states that you should only claim the fifth grant if you think your business profit will be impacted by coronavirus between 1 May 2021 and 30 September 2021.

The grant is taxable and will be paid out in a single instalment. The last date for making a claim for the fourth grant was 1 June 2021. Claims for the fourth SEISS grant have now closed.

When Is The 4th Self Employed Grant How To Claim The Seiss Payment And Who Can Apply

How To Claim 4th Self Employment Grant The Seiss Payment Explained And When The Hmrc Deadline To Apply Is

Seiss Grants Here S What You Need To Know Before The Fourth Round Opens This Month Leicestershire Live

Coronavirus Help For The Self Employed Explained Which News

Seiss Grant Hmrc Warning To Self Employed Claiming Latest Support During Pandemic Nottinghamshire Live

When Is The 5th Self Employed Grant How To Claim The Next Seiss Payment And Who Can Apply For The Scheme

When Is The 4th Self Employed Grant How To Claim The Seiss Payment And Who Can Apply

Seiss Grant 5 When Can I Claim 5th Hmrc Self Employed Grant Date Applications Open And Who Can Apply The Scotsman

Have You Correctly Claimed The Third Self Employment Income Support Scheme Seiss Grant Low Incomes Tax Reform Group

Coronavirus Seiss Fourth Grant Low Incomes Tax Reform Group

Can I Claim A Self Employed Grant How Much Will I Get And When Will It End

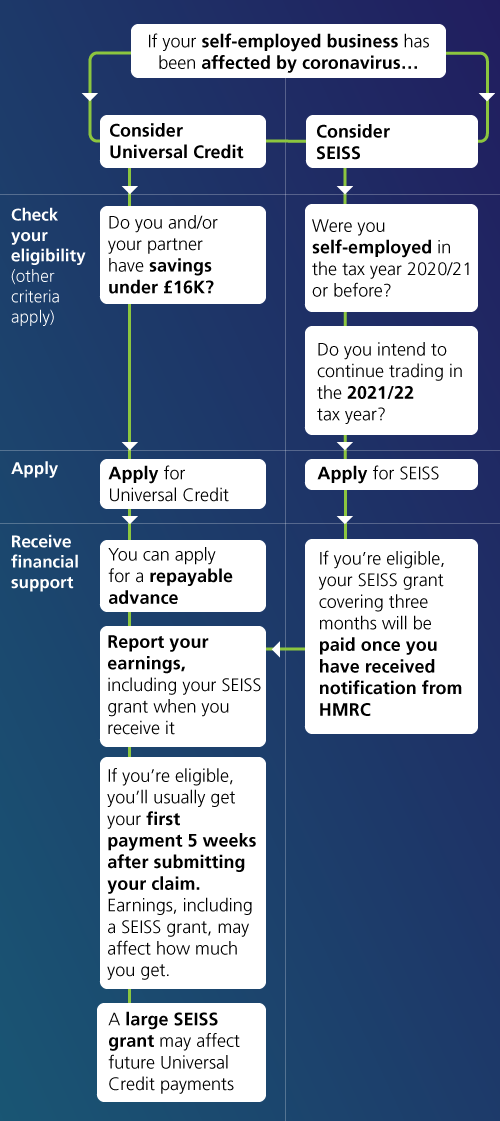

Self Employment Understanding Universal Credit

Fifth Self Employed Income Support Scheme Grant To Open For Claims In July Taxassist Accountants

Seiss 5th Grant When And How Can I Claim It Mcl

Coronavirus Help For The Self Employed Explained Which News

Self Employment Income Support Scheme Supporting Your Clients With Their Claim For The Fifth Grant Youtube

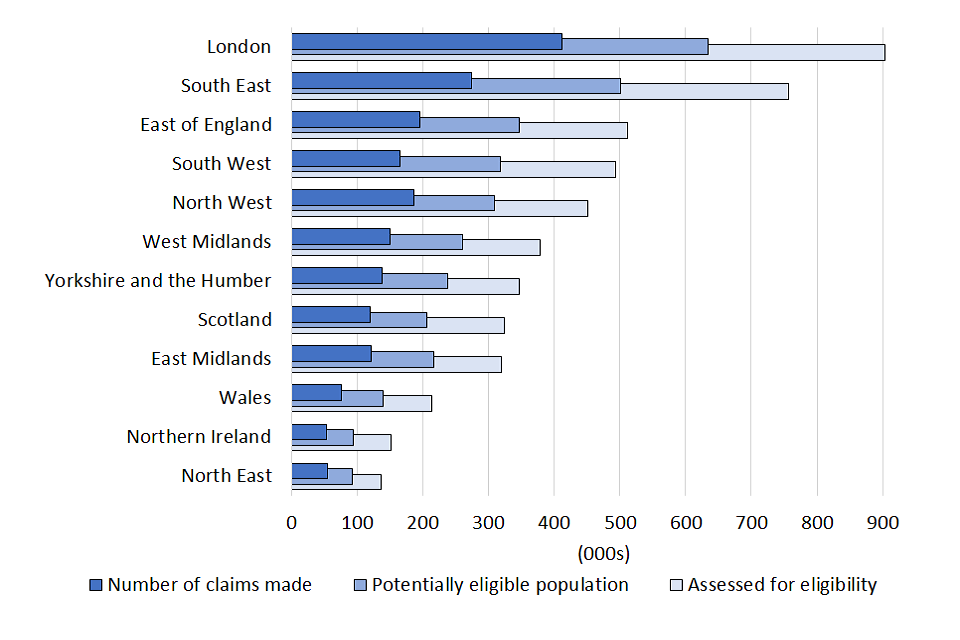

Self Employment Income Support Scheme Statistics July 2021 Gov Uk

How To Claim A Second Self Employment Income Support Scheme Grant Taxassist Accountants

How To Claim The 4th Self Employment Support Grant Explained And How Much You Will Get Business Live

Post a Comment for "Can I Claim The Self Employment Grant"